OUR GOVERNANCE FRAMEWORK

Bakkavor Group operates within a governance framework which we believe identifies

all the elements of a sound approach to governance and responsibility.

The Board, together with the Management Board, uses this framework to set and monitor

governance and responsibility objectives, identify improvement opportunities and ensure

that activities align with business strategy. Through this framework we provide assurance

to all our stakeholders that Bakkavor is a well-managed, responsible company.

WHAT DOES GOVERNANCE MEAN FOR US?

At Bakkavor, governance is about making sure that the Group Board and the Management Board:

-

have assessed the necessary options and are taking the business in the right strategic direction

-

are leading and managing the business effectively and are accountable for their actions

-

have put in place appropriate controls which are used actively throughout the business

-

consider the interests of all our stakeholders in making executive decisions

HOW DO WE MAKE THIS HAPPEN?

At Bakkavor, we believe that effective governance is realised through leadership and collaboration.

The Group Board retains ultimate responsibility for upholding corporate governance standards and

determining the strategic objectives of the Group.

The Management Board implements the strategic objectives of the Group Board, determines investment

policies, agrees on performance criteria and delegates to management of the Group operations the

detailed planning and implementation of those objectives and policies in accordance with

appropriate risk parameters.

The Management Board monitors compliance with policies and achievement against objectives by

holding management accountable for its activities through monthly and quarterly performance

reporting and budget updates. In addition, the Management Board receives regular

presentations from directors of key Group functions including Marketing, Human Resources

and Legal, enabling it to explore specific issues and developments in greater detail.

The governance framework is reinforced across the organisation and addresses all stakeholder

interests through the five Bakkavor values, which define our approach to all aspects of our

business. Our values are: Customer care, Can do, Teamwork, Innovation and Getting it

right/Keeping it right. These values are fundamental to our ability to carry out our

day-to-day business with integrity. We recruit new people and reward all managers against

their ability to demonstrate Bakkavor values in the day-to-day running of the business.

In 2012 our values were relaunched and communicated across the Group.

ABOUT OUR BOARD

OUR BOARD OF DIRECTORS BRINGS A VALUABLE AND BALANCED RANGE OF EXPERIENCE.

Board composition and effectiveness

In conjunction with the issuance of Senior Secure Notes in 2011, the Company, Bakkavor Finance

(2) plc, was incorporated and acts as a holding company of the Group. The Directors were

therefore appointed either on or subsequent to the Company's incorporation date. (For

further details of Company appointments refer to the Directors' Report). The table below

highlights the appointment of Board members to the overall Group, prior to the incorporation

of the holding company, Bakkavor Finance (2) plc.

The majority of the Board Directors were independent during the financial reporting period,

with three independent members and two non-independent members.

It is considered that the size and composition of the Board of Directors makes it possible for

it to discharge its duties efficiently and with integrity. Together, the Board of Directors

brings a valuable and balanced range of experience as they all hold senior positions in

professional and public life. (See profiles of our Board of Directors).

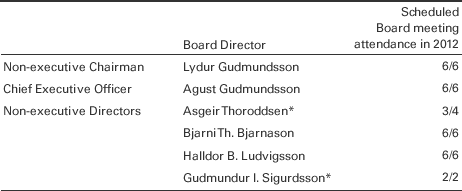

BOARD MEETINGS

The Board of Directors convened six times in 2012. The attendance is set out below.

* Asgeir Thoroddsen, Non-executive Director, resigned from the Group Board on 25 September 2012. Gudmundur Sigurdsson was appointed to the Group Board on 25 September 2012.

* Asgeir Thoroddsen, Non-executive Director, resigned from the Group Board on 25 September 2012. Gudmundur Sigurdsson was appointed to the Group Board on 25 September 2012.

In advance of each regular Board meeting, the Board members are provided with a Board report

which includes a comprehensive report of the Group's financial and operational performance,

and a broader market update. Board members are informed about all significant matters immediately.

RISK IDENTIFICATION AND MANAGEMENT

OUR DECENTRALISED MODEL EMPOWERS THE MANAGEMENT OF OUR BUSINESSES TO IDENTIFY, EVALUATE AND MANAGE THE RISKS THEY FACE.

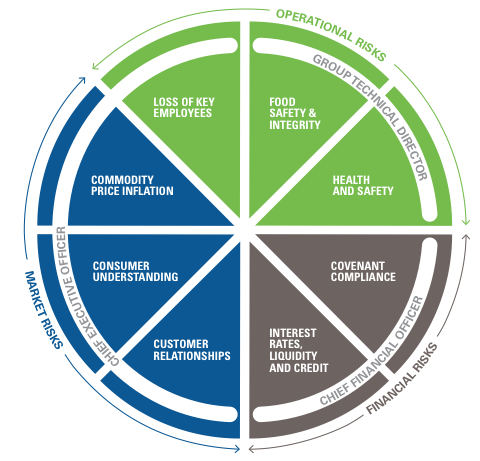

Our decentralised model empowers the management of our businesses to identify, evaluate and manage the risks they face on a timely basis. Key risks and internal control procedures are reviewed at Group level by the Management Board and the management of principal risks is assigned to key members of the Management Board. It is their responsibility to report to the Board on a monthly basis regarding the actions associated with each of those risks.

In 2011 we reported eight risks, the mitigation of which is paramount to the day-to-day running of our business and the achievement of our long-term vision. Following a risk assessment in 2012, it was confirmed that all eight identified risks remain key risks to the business. These are: Food safety and integrity, Health & Safety, Loss of key employees, Customer relationships, Consumer understanding, Commodity price Inflation, Covenant compliance and Interest rates, Liquidity & credit.

For more information about why these risks are deemed to be key, how we aim to mitigate them and who is responsible for managing them see our Risks.

CONTROLS AND COMPLIANCE

The Board conducts an annual review of the Group's systems of internal control. These systems provide

an ongoing process that identifies, evaluates and manages the risks that are significant in relation

to the fulfilment of the Group's business objectives. The systems are designed to manage rather than

to eliminate all possible risk and to provide reasonable, but not absolute, assurance against material

misstatement or loss. The system also supports management's decision-making, improves the reliability

of business performance and assists in the preparation of the Company's consolidated accounts.

RISK MANAGEMENT PROCESS

* SHE: Safety, Health and Environment

* NPD: New Product Development

AUDIT COMMITTEE

The Board has delegated authority to the Audit Committee, which comprises key management across the business, to

regularly monitor internal controls. Each year the Audit Committee meets to discuss and approve the nature and

scope of the audit programme for the year. The Audit Committee then instructs the internal audit function to

undertake the agreed schedule of audits, during which the effectiveness of the controls operating within the

business are reviewed. The Group's internal audit function, which comprises both employees and professionals

from an external provider, RSM Tenon, has the skills and experience relevant to the operation of each business.

In addition to our internal audit function, the completion of comprehensive internal control questionnaires

is required from all Financial Controllers within each business unit. These self-assessment representations

are designed to ensure that any material control breakdowns are highlighted and the operation of internal

controls is addressed within each business unit. The results of these representations are reviewed by

internal audit before being reported to the Audit Committee.

AUDITORS

The Audit Committee is also responsible for the appointment of the Company's Auditor, Deloitte LLP.

Annually the Committee reviews the relationships the Company has with Deloitte LLP and considers the

level of non-audit services provided by the Auditor. The engagement of Deloitte LLP for non-audit

services requires approval from the Group Financial Controller and, if significant, the Audit

Committee, to ensure that any services provided do not impair the objectivity of the external

Auditor. A list of non-audit services provided by Deloitte LLP in 2012 and the associated fees

has been provided in Note 6 of the Group's financial statements.

Disclosure of information to Auditor

Each of the persons who is a Director at the date of approval of this Annual Report confirms that:

- so far as the Director is aware, there is no relevant audit information of which the Company's

Auditor is unaware; and

- the Director has taken all the steps that he ought to have taken as a Director in order to make

himself aware of any relevant audit information and to establish that the Company's Auditor is aware

of that information.

This confirmation is given and should be interpreted in accordance with the provisions of s418(2)

of the Companies Act 2006.

Deloitte LLP has expressed its willingness to continue in office as Auditor and a resolution to

reappoint Deloitte LLP will be proposed at the Company's Annual General Meeting.

ENGAGING WITH INVESTORS

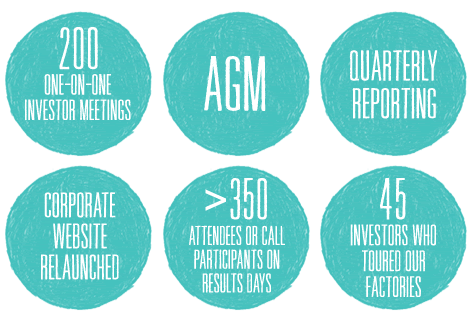

IN 2012 WE HELD OVER 600 MEETINGS AND TELEPHONE CALLS WITH INVESTORS AND ANALYSTS.

INVESTOR ENGAGEMENT PROGRAMME

The Board delegates the management of Bakkavor's investor engagement programme to our CEO, CFO and Head of External Affairs. In 2012 the team ran a comprehensive programme and held over 600 meetings and telephone calls with investors and analysts. Please refer to the Investor Relations section on our website for an overview of the 2013 Financial Calendar.